Some Known Details About G. Halsey Wickser, Loan Agent

Table of ContentsThe 2-Minute Rule for G. Halsey Wickser, Loan AgentSome Ideas on G. Halsey Wickser, Loan Agent You Need To KnowHow G. Halsey Wickser, Loan Agent can Save You Time, Stress, and Money.Not known Factual Statements About G. Halsey Wickser, Loan Agent The Main Principles Of G. Halsey Wickser, Loan Agent

The Assistance from a home mortgage broker doesn't finish when your home loan is secured. They give continuous support, aiding you with any type of questions or problems that arise throughout the life of your finance - california mortgage brokers. This follow-up support ensures that you stay satisfied with your home loan and can make informed decisions if your economic situation adjustmentsDue to the fact that they work with several loan providers, brokers can discover a finance item that suits your unique monetary circumstance, also if you have actually been refused by a bank. This flexibility can be the secret to opening your imagine homeownership. Selecting to function with a mortgage advisor can transform your home-buying journey, making it smoother, quicker, and a lot more monetarily advantageous.

Discovering the ideal home for on your own and identifying your budget can be extremely difficult, time, and money-consuming - california mortgage brokers. It asks a whole lot from you, diminishing your energy as this job can be a task. (https://www.findabusinesspro.com/united-states/glendale/general-business-1/g-halsey-wickser-loan-agent) A person who works as an intermediary between a consumer a person looking for a home mortgage or home mortgage and a loan provider commonly a bank or credit history union

See This Report on G. Halsey Wickser, Loan Agent

Their high degree of experience to the table, which can be critical in assisting you make informed choices and eventually accomplish effective home funding. With rate of interest rates fluctuating and the ever-evolving market, having actually somebody fully listened to its ongoings would certainly make your mortgage-seeking process a lot easier, eliminating you from browsing the struggles of filling in documentation and carrying out stacks of research study.

This allows them supply skilled assistance on the most effective time to secure a home mortgage. Because of their experience, they also have actually established links with a large network of lenders, varying from major financial institutions to specialized home loan providers. This considerable network allows them to provide buyers with different home loan options. They can take advantage of their relationships to discover the most effective loan providers for their customers.

With their sector expertise and ability to work out properly, mortgage brokers play a pivotal function in protecting the very best home mortgage deals for their clients. By preserving connections with a varied network of loan providers, home mortgage brokers obtain accessibility to several mortgage options. Additionally, their increased experience, described above, can give invaluable information.

All about G. Halsey Wickser, Loan Agent

They have the skills and techniques to persuade lenders to give much better terms. This may consist of lower rates of interest, lowered closing expenses, or perhaps extra versatile repayment routines (G. Halsey Wickser, Loan Agent). A well-prepared mortgage broker can provide your application and monetary profile in a means that charms to lending institutions, boosting your chances of an effective negotiation

This advantage is frequently a pleasant shock for lots of homebuyers, as it enables them to utilize the proficiency and sources of a mortgage broker without stressing over incurring additional expenditures. When a customer protects a home mortgage through a broker, the lending institution compensates the broker with a compensation. This payment is a percentage of the financing amount and is commonly based on variables such as the rate of interest and the kind of lending.

Mortgage brokers excel in understanding these differences and dealing with lending institutions to discover a home loan that suits each consumer's details needs. This personalized strategy can make all the distinction in your home-buying journey. By functioning carefully with you, your mortgage broker can ensure that your lending terms straighten with your monetary goals and capacities.

Not known Facts About G. Halsey Wickser, Loan Agent

Tailored home mortgage options are the key to an effective and lasting homeownership experience, and home loan brokers are the specialists who can make it take place. Hiring a home loan broker to function together with you might result in rapid finance approvals. By utilizing their expertise in this field, brokers can help you stay clear of potential pitfalls that often trigger hold-ups in lending authorization, leading to a quicker and a lot more efficient path to safeguarding your home financing.

When it comes to acquiring a home, browsing the globe of home mortgages can be frustrating. Home mortgage brokers act as middlemans in between you and prospective loan providers, helping you find the best mortgage deal tailored to your particular circumstance.

Brokers are fluent in the intricacies of the mortgage industry and can offer important understandings that can assist you make educated choices. Rather of being restricted to the home mortgage items used by a solitary lending institution, mortgage brokers have accessibility to a wide network of lenders. This means they can search in your place to find the ideal loan alternatives offered, potentially conserving you money and time.

This access to numerous loan providers gives you an affordable advantage when it concerns safeguarding a positive mortgage. Searching for the appropriate home loan can be a time-consuming procedure. By working with a mortgage broker, you can conserve time and effort by allowing them deal with the research and documents involved in searching for and protecting a car loan.

What Does G. Halsey Wickser, Loan Agent Do?

Unlike a small business loan officer who might be juggling multiple clients, a home mortgage broker can provide you with customized solution customized to your specific demands. They can make the effort to comprehend your economic situation and goals, using tailored solutions that align with your particular demands. Home mortgage brokers are competent arbitrators that can aid you protect the most effective feasible terms on your lending.

Mike Vitar Then & Now!

Mike Vitar Then & Now! Suri Cruise Then & Now!

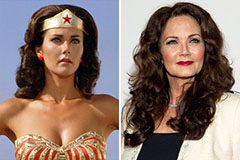

Suri Cruise Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Bernadette Peters Then & Now!

Bernadette Peters Then & Now! Erika Eleniak Then & Now!

Erika Eleniak Then & Now!